The UK may have parted company with the EU, but we will always have a great deal in common with our neighbours across the Channel. As our own population ages, so does that of other European countries, as revealed in the European Commission’s Eurostat publication “Ageing Europe — looking at the lives of older people in the EU”.

The report highlights key projections about older and retired people in the EU’s 27 member nations.

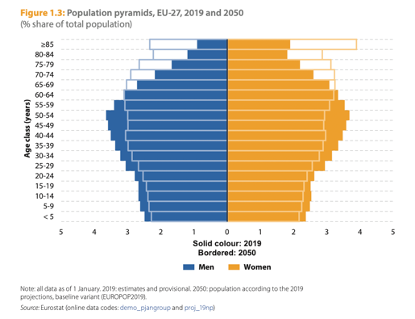

- There were 90.5 million older people (aged 65 years or over) living in the EU at the start of 2019.

- Those aged 65 or more make up just over one fifth (20.3 %) of the total EU population.

- There will be close to half a million centenarians in the EU-27 by 2050.

- In 2019, there were more than twice as many very old women (aged 85 years or more) as very old men.

- The median age will increase by 4.5 years between 2019 and 2050, to 48.2 years.

This means the average European can realistically expect to live to almost 100 years old.

A shifting demographic

Apart from being a possible testament to the health advantages of a Mediterranean diet (!), the stats show that in European countries, there will be many more older people than at present. This is accompanied by a shrinking proportion of people of working age:

“This pattern will continue in the next couple of decades, as the post-war baby-boom generation completes its move into retirement. … This transformation is likely to have a considerable impact on most aspects of society and the economy, including housing, healthcare and social protection, labour markets, the demand for goods and services, macroeconomic and fiscal sustainability, family structures and intergenerational ties.”

As the report notes, Japan is already heading down this path:

“Having had almost four working-age people (defined here as those aged 20-64 years) for each older person (aged 65 years or more) in 2000, Japan will move to a situation of having approximately 1.2 working-age persons for every older person by 2050.”

So, you may find yourself ‘competing’ with more retirees for resources in the future, from outside cabins on a cruise to live-in carers or places in quality retirement homes. Professional estate planning advice now can help you plan for long-term care and other anticipated expenditure in the future, including moving home.

Working in retirement

The Eurostat reports reveals some interesting headlines about those who continue to work into retirement. Between 2004 and 2019, the number of people employed aged 65-69 years increased “at a rapid pace”, rising by 99%.

In 2019,

- People aged 55 years or more accounted for one fifth of the total workforce

- More than half of the workforce aged 65 years or more were employed on a part-time basis in 2019

- Employed women aged 65-74 years spent an average of 25.0 hours per week at work

- More than two fifths of the workforce aged 65-74 years were self-employed

Working in retirement and estate planning

For many, working in retirement isn’t about the money. The report revealed that:

“Almost one third of older people who continued to work while receiving a pension did so for non-financial reasons.”

It’s important to note that working in retirement will have some financial implications in terms of tax and benefits. However, in terms of estate planning there is also another major consideration - business succession.

- If you’ve set up a new business in retirement, you may wish to pass it on to the next generation as a legacy in your will. It’s important to take time to think which person or persons would benefit most, or use their talents to grow that business.

- You also need to consider who would NOT want to inherit the business, or who would (frankly) be a complete disaster if they were put in charge!

- You also need to consider any partners in your business and make provision of them or others to take control if your health fails or you become incapacitated.

- Part of the business succession planning might include financial provision for long-term care for yourself and/or a spouse.

Need to adjust your plans or your future in retirement?

Call us at Panthera Estate Planning for expert advice on living better in retirement and leaving a lasting legacy for future generations.